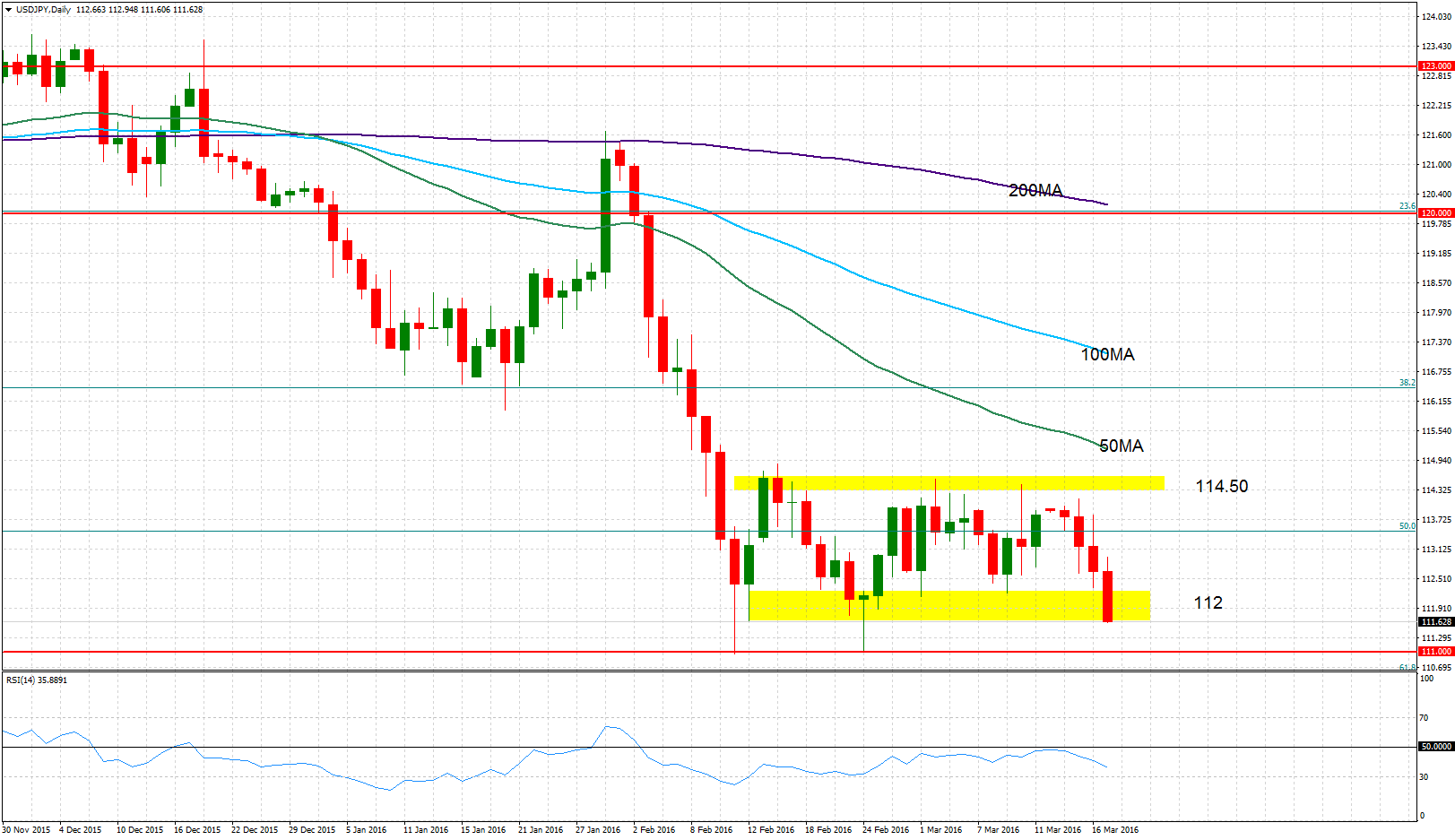

USDJPY maintains its neutral bias, trading in a broad range between 112.00 and 114.50 since mid-February.

USDJPY maintains its neutral bias, trading in a broad range between 112.00 and 114.50 since mid-February.

Only a break above 115.96 (January 20 low) would shift the near-term bias to a more bullish one. Downside risk exists as indicated by the falling RSI. Meanwhile, the negatively aligned moving averages also highlight a bearish outlook.

There is scope for prices to target the key 111.00 level. A sustained break below this level would develop into a deeper correction of the long term uptrend that started from the end of 2011 when the market bottomed at 75.55 and rose to a 13-year high of 128.84 in mid-2015. The MACD in the long term chart is bearish and is below zero.

Origin: XM